Note: This is part 3 of 3. See also here and here.

The Traditional Banking System

A small business woman who has been operating her firm for several years on a shoestring budget but always managed to turn a tidy profit walks into an appointment with her local banker. She has prepared for weeks for this half hour to present her business prospects and her preparation will pay off. A $100,000 loan is approved and within a week that amount is added to her checking account at the bank.

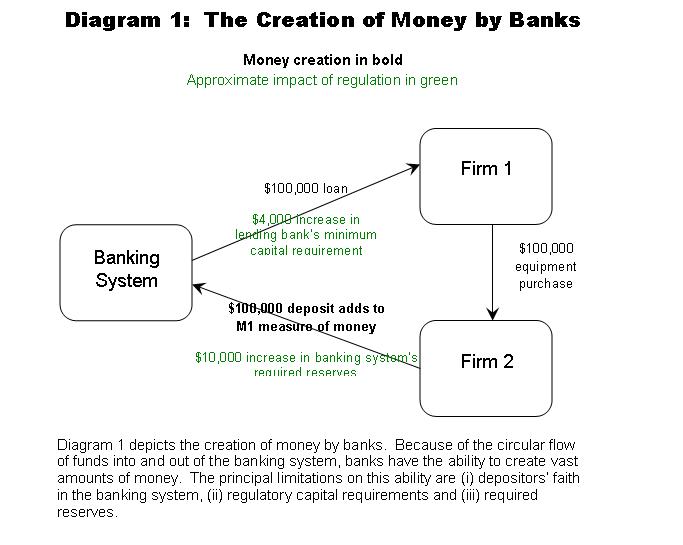

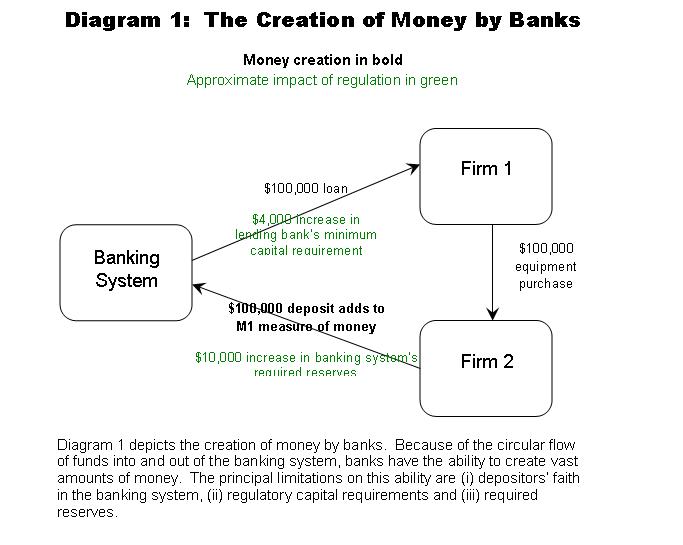

It’s worth pausing to think for a moment about where that $100,000 of loan money comes from. When a bank finds a creditworthy borrower who is able and willing to pay a market rate of interest on a loan, the bank does not need to have cash on hand. Any bank has the capacity to create money by simply crediting the borrower’s checking account with the amount approved for the loan. From the bank’s point of view both its loans and its deposits increase by $100,000. However, since checking accounts are an important component of the money supply, from the economy’s point of view, the bank has just created money out of thin air.

The limitation on the bank’s ability to create money is its capital stock. While the calculation of regulatory capital requirements is complex, in general a bank’s capital should be no less than 4% of its total loan portfolio. Thus in order to make the $100,000 loan, the bank will have to have $4,000 of capital over and above the capital required before the loan was made. Now, you need to understand that capital is, by definition, not money that a bank can raise by borrowing. The capital that stands behind a bank’s loans needs to be the bank’s own money – it cannot be owed to depositors or other banks or even to a Federal Reserve Bank. Capital is the money the owners of the bank have invested in it plus any profits that have been reinvested.

Of course, for every $4,000 the owners invest, the bank can make $100,000 worth of loans, so a bank’s ability to create money is substantial, even if it is limited. Furthermore, the bank can earn interest on the whole $100,000, so capital requirements leave plenty of room for a bank to make good profits on its lending activities. For this reason, in a country with a well functioning banking system borrowing is usually not particularly difficult for those who can convince a bank that they are creditworthy.

(For any reader who’s just decided that opening a bank is surefire way to solve all of your financial problems, I have to inform you that that scam has been tried so many times that the regulators are already on to you: Loans to the managers and owners of a bank are tracked very closely.)

It’s true also that the bank will be required to hold reserves against the $100,000 increase in deposits. A $100,000 increase in deposits will lead approximately to a $10,000 increase the balance the bank is required to hold at its local Federal Reserve Bank. This, however, is not a constraint on the bank’s lending to good clients, because the bank can always choose to borrow the $10,000 at an interest rate significantly lower than the one it is charging its customer. Furthermore, our business woman undoubtedly borrowed the money because she had a use for it, so that $100,000 is not likely to sit in the bank increasing required reserves for long.

It is important to notice in this example that our bank has not used depositors’ money to make this loan. Even if our business woman uses the full $100,000 to write a check purchasing a piece of equipment, the bank still does not need to turn to depositors to fund the loan. When the check is cleared, as far as the Fed is concerned $100,000 of the bank’s reserves have been transferred to another bank. Our bank, however, can simply replace the reserves by borrowing them on the interbank lending market at an interest rate well below that which it is earning on the loan.

Some might argue that in order for there to be funds available for borrowing on the interbank lending market it must be the case that some bank has deposits that have not yet been lent out. This is indeed true, but, of course, we know that some bank has deposits that have not yet been lent out – because some bank just received the $100,000 in deposits that our bank created.

In fact, the only circumstance in which depositors’ money would be needed to fund the loan is when our business woman takes the $100,000 in cash from the bank and spends it somewhere, where it will not be deposited back in the banking system. This is one of the reasons that economies which rely heavily on banks find that simply being a banked economy gives them a huge boost in terms of economic growth: banked economies have an easy time creating money to meet the needs of entrepreneurs, whereas under-banked economies have a much less effective mechanism for making loans via money creation. (See Diagram 1.)

It is true that the Fed can choose to restrain the banking system from creating money so easily. This is possible because the Fed can use open market operations to control the total quantity of reserves available to the banking system. The $100,000 loan/deposit that was just created raises the total quantity of reserves that the banking system as a whole needs to maintain by $10,000.

If the Fed keeps the total quantity of reserves constant, we will see that the demand for reserves on the interbank lending market has increased without a change in supply. This will mean that banks with reserves available for lending can charge a higher price, and we would observe an increase in the federal funds rate, which is the interest rate at which banks lend reserves from one to another.

Since the 1980’s, however, it has been Federal Reserve policy to manage reserves with the goal of ensuring that the federal funds rate is at a specific target level. Thus, for the most part banks find that as they create money by making loans and generating deposits the Fed increases the supply of bank reserves to accommodate the increase in the money supply. Of course, when the Fed has just put into place a policy of tightening the money supply and raising the federal funds rate, there is a sudden reduction in reserves. Once the new, higher target interest rate has been reached, banks can again expect the supply of reserves to expand as they generate new – higher interest rate – loans.

As a tool of monetary policy, changing the target level of the federal funds rate is a very effective way of changing the lending behavior of all the banks in the economy. When banks have to pay more to borrow reserves, they charge a higher interest rate to the customers who are borrowing from them, and this higher interest rate has the effect of reducing the amount that people want to borrow from banks. This is the actual mechanism by which modern monetary policy can put a damper on bank lending and on money supply growth. Of course, lowering the federal funds rate has the reverse effect.

Because the Fed can choose to set the interbank borrowing rate so high that there is very little demand on the part of businesses and individuals for loans, the Fed has the power to put a complete stop to money creation by banks. In fact in the early 1980s, the Fed actually caused the federal funds rate to rise above 18%. While this was a short-term policy with a very specific policy goal, it was remarkably effective at bringing the economy to a standstill. Needless-to-say, this was an exceptional circumstance, and typical Fed policy does not involve stopping the money creation function of banks or the economic activity it generates, even temporarily.

The key here is to understand what it means when we say that banks create money: Banks generate deposits by making loans. This process creates an interdependent relationship between the local business community and the local banking system, because both benefit from each other.

Regulators limit the banking system’s ability to create money by setting a target level for the interest rate at which reserves are borrowed on the interbank lending market. This monetary policy is intended to keep banks from creating so much money that prices and inflation start to rise.

At the level of the individual bank, regulators limit the bank’s ability to create money by imposing capital requirements. Capital requirements put banks in a position where the owners of the bank can afford to absorb the expense of loans that have gone bad. If the quantity of bad loans exceeds the capital position of the bank, the bank will go bankrupt, and in the absence of deposit insurance, depositors will experience losses. In the presence of deposit insurance, the purpose of capital requirements is to keep the claims on the deposit insurer to a minimum so that the deposit insurer does not risk bankruptcy – which in the US will trigger a taxpayer bailout of the deposit insurer.

Hopefully the attentive reader now has alarm bells ringing in his head: “Wait a minute, didn’t you just say in the last chapter that one purpose of creating asset backed commercial paper conduits was so that banks could make loans that weren’t subject to the regulators’ requirements? What’s supposed to keep bad loans from driving the conduits into bankruptcy if they aren’t subject to capital requirements? What’s supposed to keep the money supply from growing so fast that inflation takes off, if conduits aren’t subject to reserve requirements?”

Good questions.

The parallel or shadow banking system

Recall how an asset backed commercial paper conduit functions: money market fund managers buy asset backed commercial paper and, thereby fund a wide variety of loans that traditionally were made by banks. Asset backed commercial paper conduits invest in residential and commercial mortgages, unsecured corporate loans, automobile loans, credit card receivables, other accounts receivable, corporate and government bonds and a whole variety of structured finance products like CDOs, CLOs and SIVs.

The reason that Paul McCulley of Pimco coined the term “the shadow banking system” to describe the early 21st century role of ABCP is that ABCP conduits perform the same function in the economy that banks do. Investors in money market funds often treat them as interest-bearing bank accounts – with the understanding that they are uninsured accounts. The fact that over a 40 year history there has been only one case in which a money market fund lost money contributes to investors’ impression that they are no different from deposits, as does the fact that many funds come with check books.[1] When money market funds invest in ABCP conduits, their loans are use to finance corporate working capital, corporate fixed capital and residential investment. Traditionally, it was the banking sector that specialized in these areas of finance, particularly for small and medium sized firms. See Diagram 2 for an illustration of how ABCP can be used to create money.

ABCP conduits are like banks because both depend on deposit-like financing that can be withdrawn at very short notice, and both use these funds to invest in longer-term assets such as mortgages and corporate loans. The crucial difference between the banking system and the ABCP market is that the banking system has access to financial support services when it runs into problems.

After the Great Depression in which one third of all banks failed, the FDIC was created to provide federal insurance for bank deposits, and the Federal Reserve took on the responsibility of supporting sound banks through a crisis. Precisely because the government has committed to support the banking system through a financial crisis, the banking industry is possibly the most regulated industry in the country.

Thus the difference between the ABCP market and the banking system is that the latter is protected from a bank run by (i) the fact that every bank can borrow directly from the Federal Reserve in case of a sudden withdrawal of deposits and (ii) deposit insurance. Because the federal government guarantees that depositors’ funds will be repaid even when a bank goes bankrupt, there is no reason for depositors to flood an unstable bank with withdrawal requests.

The fact that the ABCP market is both unregulated and unprotected explains why it is called the “shadow” banking system. ABCP conduits have no required reserve ratios and no capital requirements. They are subject only to the discipline of the market. Unfortunately, ABCP usually matures in three months or less and typically pays less than one half of one percent more than Treasury securities. For this reason the cost to an investor of carefully reviewing a conduit’s assets and structure generally exceeds the benefits an investor can expect from investing in the ABCP of the conduit. And so we find that the evaluation of a conduit’s creditworthiness was outsourced to the credit rating agencies.

The end result of an environment where “market discipline” is enforced only by the threat of a downgrade from the credit rating agencies is that the credit rating agencies become the de facto regulators of the ABCP market. The credit rating agencies are, of course, not true regulators, because stability of the ABCP market as a whole is not within their purview. They have a much narrower agenda: they evaluate only the ability of individual conduits to repay the commercial paper that they issue. To put it bluntly, as long as contracts are in place to ensure that the commercial paper issued by the conduit will be repaid even if the conduit collapses, the credit rating agencies don’t need to do a thorough evaluation of the risk of collapse of the ABCP conduit itself.

The credit rating agencies recognized that ABCP conduits, like banks, are subject to runs, because money market investors can suddenly decide to withdraw their funds, and they recognized that, as is the case with banks, bad assets can bankrupt a conduit and generate losses for ABCP investors. To address the liquidity risk, instead of required reserves, conduits must have access to a liquidity facility that stands ready to cover their whole issue of commercial paper. It is the banks that provide this liquidity facility in exchange for a fee. To address the credit risk, instead of capital requirements, ABCP conduits are also required to pay the banks for credit enhancement, which offers some protection against bad assets.

In short, the credit rating agencies “regulated” the ABCP conduits by requiring that the banking system stand ready to support all of a conduit’s commercial paper in case of a run and be ready to support a conduit’s bad debt as long as it remained below a certain fraction of assets. Because conduits were never required to be capitalized or to maintain reserves, in retrospect we can conclude that the ABCP market was indeed a shadow banking system – it was entirely dependent on the real banking system and could never hope to stand alone.

The problem with this system where highly regulated banks support an alterego that is monitored only by the credit rating agencies, is that nobody can be responsible for the stability of the integrated system. Bank regulators tried to limit the banks’ exposure to conduits by adjusting the capital requirements relating to liquidity facilities and credit enhancement. In the meanwhile, the credit rating agencies were approving the use of liquidity and credit facilities that allowed banks to evade the intent (if not the letter) of the regulatory requirements. An example of this is the liquidity put described in the previous chapter.

I should note here that the term “shadow banking system” was coined after the financial community experienced a run on asset-backed commercial paper.[2] While it is easy to see in retrospect that it was a mistake for regulators to allow the development of a parallel banking system in which bank supported lending took place beyond their view, the simple fact is that only a very, very few people recognized how profoundly unstable financial markets can be.[3] Everyone else thought it was simply impossible for a market with as many participants as the ABCP market to find that suddenly there were no buyers – and not just for one week, but for week after week after week. Because of this profound failure to understand the nature of financial markets, regulators viewed the growth of ABCP as a benign event, which served only to increase the availability of credit throughout the economy. [4]

The parallel banking system matures

By 1997 the ABCP market was well enough established to grow at a rate of more than $100 billion each year. While 2002 saw the start of a three-year break in this pattern of strong growth, this is easily explained by the collapse of Enron and the consequent uncertainty surrounding the regulation of ABCP conduits. By the middle of 2004 the regulatory issues had been resolved and ABCP was once again growing at a rate of more than $100 billion a year.

The greatest growth in ABCP took place from June 2006 to June 2007. In this period, ABCP increased by more than $238 billion. As domestic deposits in the banking system over the same period grew by $255 billion, the ABCP market was providing almost as much additional liquidity to the U.S. economy as the banking system itself.

In this period from June 2006 to June 2007, banks were required to back any assets that were supported by a liquidity facility with one tenth of the capital that would be required if the asset was owned by the bank. Against any assets that were supported by credit enhancement the bank was required to hold capital just as if the asset were on its balance sheet. If 10% of the average conduit’s assets had a credit enhancement, then each dollar of bank capital could support approximately $125 of loans when the loans were placed in a conduit (as compared to $25 when the loans were kept by the bank).

One thing is clear. The outsourcing of bank lending to ABCP conduits made it possible for bank capital to support a far greater number of loans than could have been supported in the traditional banking sector. Since housing prices were rising at the same time as a massive increase in securitization was taking place and the increase in ABCP represented in part an increase in the funds available to finance the purchase of homes, it is entirely possible that this increase in funds contributed to the increase in housing prices. In other words, the price inflation we have seen over the past year in housing and other real estate, may be explained, in part, by the growth of conduits that were subject only indirectly to regulatory capital requirements.

[1] In 1994 Community Assets Management paid only 96 cents on the dollar to investors. Money market funds were added to the definition of M2 in 1980.

[2] I believe the first use of the term is by Paul McCulley of Pimco in his September 2007 newsletter. http://www.pimco.com/LeftNav/Featured+Market+Commentary/FF/2007/GCBF+August-+September+2007.htm

[3] Raghuram Rajan is one.

[4] On the other hand, there were quite a few in the investment world who viewed the growth of asset backed commercial paper and, in particular, its important role in funding complex structured finance products with caution and even concern. Several money market fund managers took a conservative approach and avoided asset-backed commercial paper entirely.